What You need to Know about Investing Your Cash!

In the event you do not need reliable information, investing in actual estate can be exhausting. This text is going to offer you info that is significant in order that you don't find yourself shedding money. Read by Don't Make Any Investments With out Studying This First! of the data rigorously and apply it to your future investments!

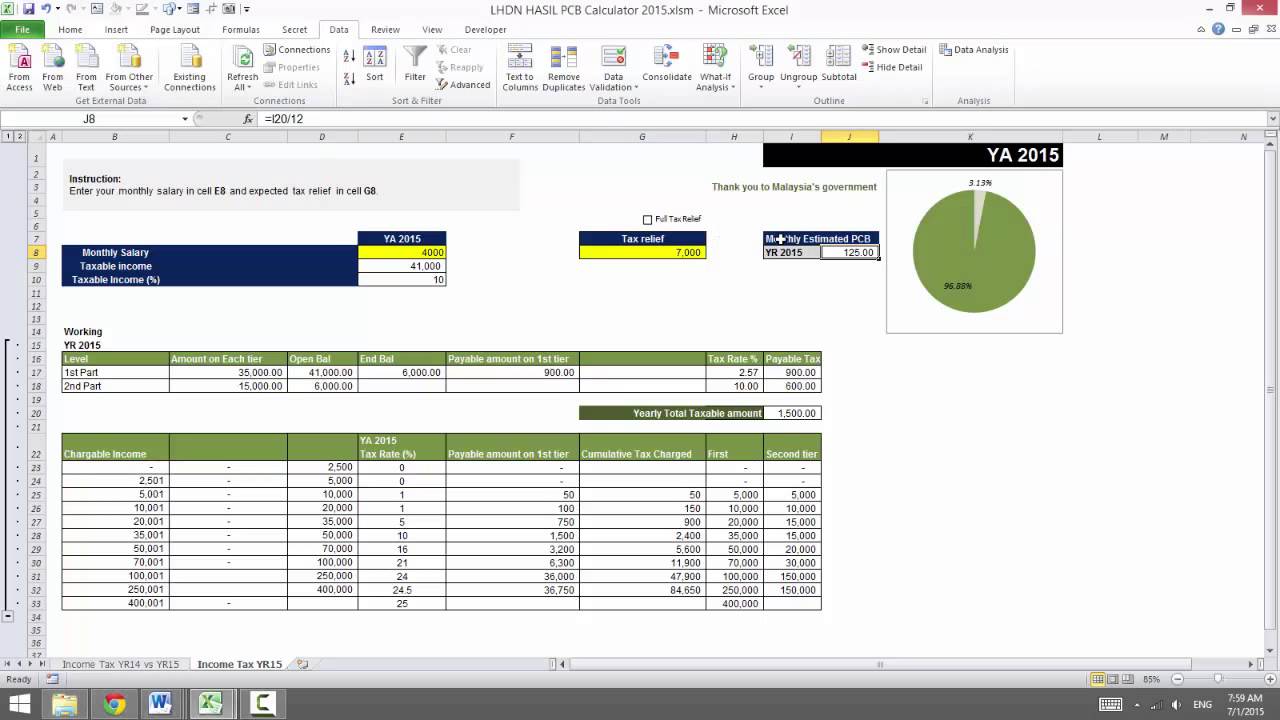

Get an understanding of tax legal guidelines and current changes. Tax laws are updated and amended repeatedly which means it's as much as you to sustain with them. Sometimes Terrific Recommendations on Investing In Actual Property on a property can really up the hassle. When it seems to be getting to thick to handle, consider a tax advisor.

For these trying in direction of placing their money into real property, attempt to keep in mind that the location is prime precedence. You may all the time change carpets or the exterior of a house. You're more likely to make a foul investment when you purchase any property in an space that is rapidly depreciating. As you consider properties, always look at the world and the potential of the properties.

While you invest in real property to rent the property, make certain you're in a position to get your cash back within an affordable amount of time. If What Everyone Should Find out about Investing takes you years to get the cash back in rental payments, then it will likely be hard for you to make use of the cash on anything property related.

When investing in Want to Get Began With Investing? The following tips May also help! , you will need to get the principal cash returned to you, plus some profit. If you are able to spend money on properties simply to get the cash back you spent, you will be wasting time which prices you. At all times ask greater than you spent so that you recoup the money you spent fixing it up.

Have a business account, and keep on with using it. If you make investments an excessive amount of of your personal cash in a property, you may lose money. This would possibly go away you quick on funds to pay your payments or take care of non-public wants. Deal with this like a enterprise so you do not threat losing all of it.

Buy in some main foreclosure areas if you're able to keep the property a bit earlier than you promote it. Finally, these areas will get higher and you will make a big profit. Understand that it could be a while earlier than you may money in and get your cash back, nevertheless.

All the time display your tenants. Realizing who you will be renting your properties to is vital. Run a background check. Ensure they do not have a spotty and irregular historical past with paying their rent on time. Discovering out about your tenant's historical past can save you plenty of bother later.

There are a couple of things you need to bear in mind with regards to negotiating your investments in actual estate. First, it is best to spend extra of your time listening than talking. Second, by no means anticipate what the seller is pondering. It's best to watch out for your own interests so you can also make extra money.

You would possibly think you've got an concept on when a house will sell, however there is no such thing as a assure of accuracy. Keep this thoughts if you find yourself evaluating your threat in buying a property. Will you pay money or finance? What are current curiosity rates? Do you wish to rent before you find yourself selling?

Create a bookkeeping system now. Know the way you plan to do your accounting now before you start. The sooner you can get into the behavior of putting the numbers in the proper place, the better off you can be. It can be an enormous mess later on balancing your books if you relied on an informal system.

Diversification is a superb key to investment success. In case you are only placing your money in one place, you'll only achieve from one. Unfold your cash by way of totally different courses of investments and you can see multiple options. This will relieve a few of the strain if any particular space sees a decline.

Always know the dangers that you are dealing with. Normally, the higher the chance, the larger the potential payoff will likely be. However together with that higher threat also comes a much bigger likelihood of not making any cash at all. So assess the danger stage and ensure it is in your comfort zone.

You need to know more about investing in actual property after studying this article. You really must make certain that you're taking some time so the results you get are good. If you're feeling ready now, go for it!